The digital entertainment sector has evolved far beyond simple pastimes, transforming into a sophisticated industry that demands rigorous corporate strategy and technical precision. In regions experiencing rapid digital adoption, such as the burgeoning online game platform Indonesia market, the success of a service depends on more than just luck. It requires a deep understanding of market penetration, user behavior analytics, and the ability to scale infrastructure in real time. Platforms like 55fivelogin.com represent this new wave of business-centric gaming, where every user interaction is backed by a complex framework designed to balance high-speed entertainment with corporate sustainability.

Risk Management: The Corporate Heart of Gaming

At its core, the gambling industry is the world’s most visible laboratory for risk management. Just as a traditional financial institution must hedge against market volatility, a digital gaming platform must manage the mathematical edge while ensuring liquidity and payout reliability. This is not merely about setting odds; it is about the “Business of Probability.”

Modern platforms employ data scientists to monitor patterns and identify potential fiscal irregularities. This level of oversight ensures that the ecosystem remains solvent and fair. By applying these rigorous financial controls, the platform protects its own bottom line while simultaneously building a reputation for integrity among its professional clientele. In the business world, a reputation for reliability is the most valuable currency, and in the digital gaming space, it is the primary driver of long-term growth.

Scalability and the Technology Stack

From a business perspective, the “product” is not just the game itself, but the stability of the delivery system. A platform must be able to handle a massive influx of concurrent users during peak hours without a dip in performance. This requires a significant investment in cloud infrastructure and edge computing.

Key technical assets include:

-

High-Availability Servers: Ensuring zero downtime during high-traffic sports events or tournament finals.

-

Modular API Integration: Allowing the platform to quickly plug in new gaming content from third-party developers without overhauling the core system.

-

Low-Latency Processing: Critical for real-time betting where a delay of a few seconds can change the financial outcome of a trade or bet.

By viewing the gaming interface as a software-as-a-service (SaaS) model, 55fivelogin.com can pivot and adapt to new market trends with the agility of a fintech startup.

Customer Acquisition and Lifetime Value

In the competitive landscape of digital commerce, the cost of acquiring a new customer is high. Therefore, the business focus shifts toward Customer Lifetime Value (CLV). This is achieved through sophisticated loyalty programs and “gamified” marketing strategies that encourage consistent engagement.

Data-driven marketing allows platforms to segment their audience with surgical precision. Instead of a one-size-fits-all approach, users receive personalized offers based on their historical preferences and spending habits. This bespoke user experience mirrors the high-touch service found in private banking or luxury retail. When a platform understands what a user wants before they even search for it, the barrier to exit becomes much higher, securing a steady stream of revenue for the enterprise.

The Regulatory Horizon

As the industry matures, the business of gambling must also navigate an increasingly complex global regulatory environment. Compliance is no longer a hurdle but a competitive advantage. Companies that proactively adopt Responsible Gaming protocols and transparent auditing practices are the ones that survive legislative shifts.

The future of the industry lies in this marriage of high-stakes excitement and sober business ethics. As digital platforms continue to integrate with traditional financial systems, the line between “gaming” and “fintech” will continue to blur, creating a robust, regulated, and highly profitable sector of the modern global economy.

The UK already has some of the toughest gambling rules in the world, which is why British players EU casinos are increasingly part of the conversation. But pressure keeps building for more. Campaigners argue that current measures don’t go far enough to protect vulnerable players. Politicians face growing concern about addiction, debt, and mental health. So what actually happens if the UK tightens gambling rules even more? The short answer: the effects would spread far beyond betting shops and apps. Players, operators, sports, and even the government would feel it.

The UK already has some of the toughest gambling rules in the world, which is why British players EU casinos are increasingly part of the conversation. But pressure keeps building for more. Campaigners argue that current measures don’t go far enough to protect vulnerable players. Politicians face growing concern about addiction, debt, and mental health. So what actually happens if the UK tightens gambling rules even more? The short answer: the effects would spread far beyond betting shops and apps. Players, operators, sports, and even the government would feel it.

Millions chase lucky numbers daily in India’s underground betting scene. Satta King 786 stands out as a popular choice among players. Platforms track results and build communities around these games. They turn simple data into full businesses.

Millions chase lucky numbers daily in India’s underground betting scene. Satta King 786 stands out as a popular choice among players. Platforms track results and build communities around these games. They turn simple data into full businesses. Sports betting has a way of pulling people into emotional traps. You watch your favorite team, the odds look tempting, and you convince yourself you’ve spotted an edge. But more often than not, those “gut” calls aren’t as sharp as they feel in the moment. That’s where

Sports betting has a way of pulling people into emotional traps. You watch your favorite team, the odds look tempting, and you convince yourself you’ve spotted an edge. But more often than not, those “gut” calls aren’t as sharp as they feel in the moment. That’s where  Slot diversification: JILI has added to a larger range of slot games, including those not traditional table games, live casino, and video poker.

Slot diversification: JILI has added to a larger range of slot games, including those not traditional table games, live casino, and video poker. Slot machines are a much-loved pastime for so many, yet it can be easy to overlook the tax consequences of your wins. Whether you’re a casual player or someone with a bankroll large enough to run a gaming operation, understanding the tax laws that apply to your slot machine winnings, even on a trusted slots 2025 (slot terpercaya 2025) is crucial. After all, there’s no reason to be hit with a tax shocker after an already bright and exciting lights kind of day.

Slot machines are a much-loved pastime for so many, yet it can be easy to overlook the tax consequences of your wins. Whether you’re a casual player or someone with a bankroll large enough to run a gaming operation, understanding the tax laws that apply to your slot machine winnings, even on a trusted slots 2025 (slot terpercaya 2025) is crucial. After all, there’s no reason to be hit with a tax shocker after an already bright and exciting lights kind of day. No more manual spreadsheets. Modern casino CMSs simplify inventory management. See machine performance, maintenance, and player preferences at a glance.

No more manual spreadsheets. Modern casino CMSs simplify inventory management. See machine performance, maintenance, and player preferences at a glance. Suppose there were very low betting limits in a casino. The day’s results could be thrown for a loop if a high roller strolls in and bets a huge sum. Risk management is useful in this situation. Businesses can reduce the financial risks linked to excessive wagering and possible fraud by instituting responsible betting limits and conducting behavior analysis on customers.

Suppose there were very low betting limits in a casino. The day’s results could be thrown for a loop if a high roller strolls in and bets a huge sum. Risk management is useful in this situation. Businesses can reduce the financial risks linked to excessive wagering and possible fraud by instituting responsible betting limits and conducting behavior analysis on customers.

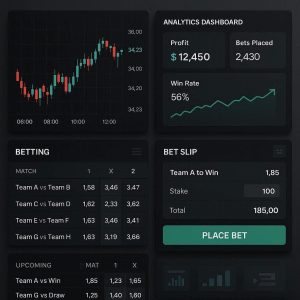

Betting used to be seen as a simple activity based on chance. People placed bets, waited for results, and accepted whatever happened. Today, betting works very differently. It has grown into a structured industry that operates like a modern business. Platforms plan carefully, study data, and build systems to support long-term growth. Luck still plays a role, but structure now matters just as much.

Betting used to be seen as a simple activity based on chance. People placed bets, waited for results, and accepted whatever happened. Today, betting works very differently. It has grown into a structured industry that operates like a modern business. Platforms plan carefully, study data, and build systems to support long-term growth. Luck still plays a role, but structure now matters just as much. The gambling industry has changed fast over the past decade. What was once limited to physical casinos is now available on mobile phones. Cassino Bet apps have become a major part of this shift. These apps are not only about games. They are also strong business platforms. They use technology, marketing, and data to grow revenue and reach new users.

The gambling industry has changed fast over the past decade. What was once limited to physical casinos is now available on mobile phones. Cassino Bet apps have become a major part of this shift. These apps are not only about games. They are also strong business platforms. They use technology, marketing, and data to grow revenue and reach new users. Gambling has changed a lot in the past decade. It is no longer limited to casinos or betting shops. Today, betting apps allow people to place wagers using their phones anytime and anywhere. This shift has created a strong connection between business and gambling. What was once a physical industry has now become a digital business model driven by technology, data, and user behavior.

Gambling has changed a lot in the past decade. It is no longer limited to casinos or betting shops. Today, betting apps allow people to place wagers using their phones anytime and anywhere. This shift has created a strong connection between business and gambling. What was once a physical industry has now become a digital business model driven by technology, data, and user behavior.

More than 70% of casino revenue worldwide comes from slot machines. These colorful, flashing games are not just entertainment; they are carefully engineered profit engines. While table games like poker and blackjack get the spotlight, slots quietly bring in steady earnings that keep casinos thriving.

More than 70% of casino revenue worldwide comes from slot machines. These colorful, flashing games are not just entertainment; they are carefully engineered profit engines. While table games like poker and blackjack get the spotlight, slots quietly bring in steady earnings that keep casinos thriving.

If the match is hosted in Indonesia or Japan, the local economy benefits from a surge in tourism. Hotels, restaurants, and transportation services experience noticeable spikes in demand. Football tourism—especially tied to major qualifiers—drives millions in short-term economic activity.

If the match is hosted in Indonesia or Japan, the local economy benefits from a surge in tourism. Hotels, restaurants, and transportation services experience noticeable spikes in demand. Football tourism—especially tied to major qualifiers—drives millions in short-term economic activity.

The Thai government rigorously controls internet gaming. A company’s legal operation depends on acquiring a license. Navigating this difficult process requires working with seasoned legal counsel.

The Thai government rigorously controls internet gaming. A company’s legal operation depends on acquiring a license. Navigating this difficult process requires working with seasoned legal counsel. Baccarat has long been a favorite game among high-stakes players worldwide, especially in luxury casino resorts. Unlike other card games, Baccarat attracts high rollers due to its straightforward gameplay, competitive odds, and the allure of exclusivity that casinos work hard to maintain. High rollers play a crucial role in boosting casino profits. Top casinos have devised strategies to cater specifically to these players, enhancing both their gaming experience and the casino’s revenue.

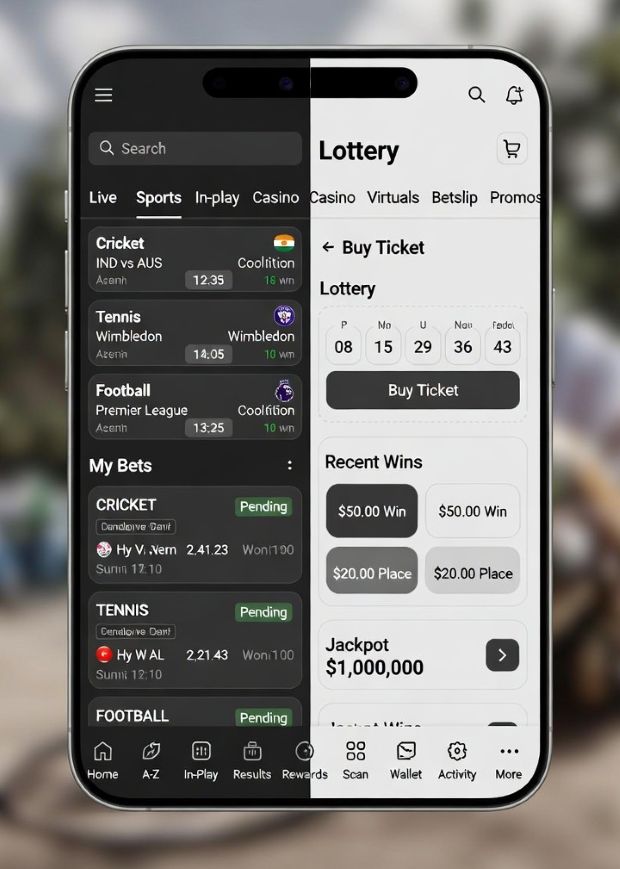

Baccarat has long been a favorite game among high-stakes players worldwide, especially in luxury casino resorts. Unlike other card games, Baccarat attracts high rollers due to its straightforward gameplay, competitive odds, and the allure of exclusivity that casinos work hard to maintain. High rollers play a crucial role in boosting casino profits. Top casinos have devised strategies to cater specifically to these players, enhancing both their gaming experience and the casino’s revenue. Online lottery platforms are rapidly changing the gambling industry, providing users with easier access to various games from anywhere in the world. These platforms have become trusted agents, offering secure services and boosting users’ confidence. The global lottery market, worth billions, has seen significant growth due to these online services, leading to new business opportunities for operators and a shift in how gambling is perceived.

Online lottery platforms are rapidly changing the gambling industry, providing users with easier access to various games from anywhere in the world. These platforms have become trusted agents, offering secure services and boosting users’ confidence. The global lottery market, worth billions, has seen significant growth due to these online services, leading to new business opportunities for operators and a shift in how gambling is perceived.