Global online gambling revenue passed the $90 billion mark in recent years, driven by mobile access, digital payments, and shifting consumer habits. What once relied on physical locations and paper tickets now lives on apps and websites, where wagers are placed in seconds and results arrive instantly. This shift has reshaped how betting companies think about scale, trust, and long-term growth.

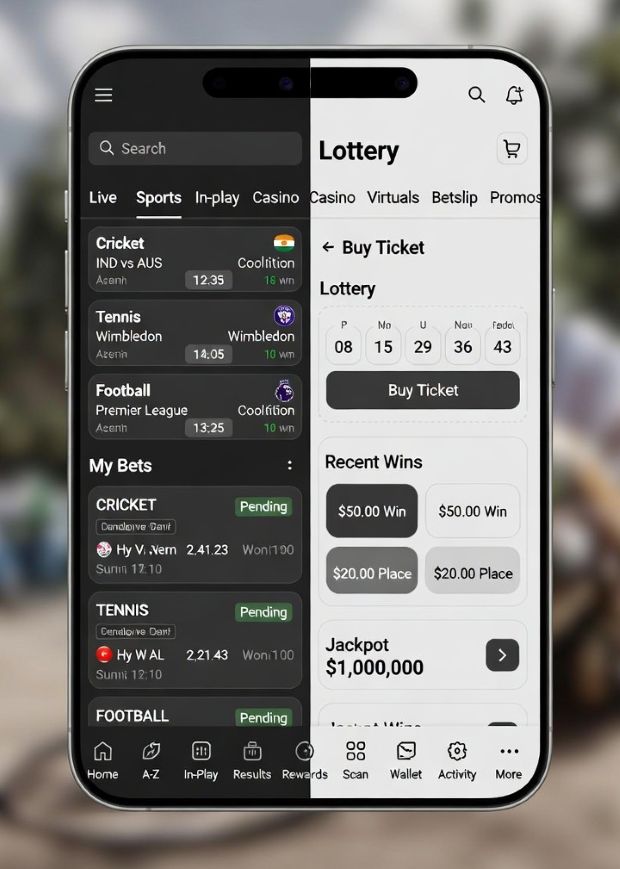

Sports betting often captures headlines, yet lottery products quietly deliver something many operators value more, steady engagement from a broad audience. Platforms that help users buy lottery online (ซื้อหวยออนไลน์) tend to attract first-time bettors who want low-cost entry, simple rules, and transparent outcomes. These services are no longer side features, they are strategic assets that introduce users to regulated wagering in a familiar way.

Why Lottery Platforms Matter to Digital Gambling Businesses

Businesses that understand how and why people buy lottery online will be better positioned to grow, adapt, and compete in the expanding global betting market.

Lotteries offer predictable demand. Draw schedules are fixed, ticket prices are affordable, and participation spans age groups and income levels. From a business view, this creates recurring traffic and consistent transaction volume. While sports betting spikes around major events, lottery play continues week after week, filling revenue gaps during quieter sports calendars.

Online lottery systems are also easier to scale. The products are standardized, and odds are centrally managed by licensed operators. This allows platforms to automate ticket issuance, payment processing, and payout verification. The result is lower operational cost compared to complex in-play sports betting markets.

Digital Trust as a Growth Engine

Trust drives conversion in online wagering. Lottery platforms have invested heavily in visible safeguards, clear rules, and fast payouts. Many publish draw results in real time and keep transaction histories easy to review. For users, this clarity builds confidence. For operators, it reduces disputes and customer support costs.

As users grow comfortable with online lottery participation, they often explore other features within the same ecosystem. Account wallets, identity verification, and payment methods are already set up, which lowers friction when a platform introduces new betting options. This shift reflects broader industry changes, as explained in analyses of how online lottery platforms are reshaping the gambling business, where trust and operational clarity drive long-term engagement.

Cross-Selling From Lottery to Broader Betting

Lottery players behave differently from sports bettors, but their habits reveal useful insights. They check results regularly, respond well to reminders, and value simplicity. Operators can apply these lessons across their platforms by simplifying onboarding flows and offering clear explanations for odds and payouts.

Seasonal promotions tied to lottery draws often outperform complex bonus schemes. When these users later encounter sports or horse betting options, they are more likely to engage if the experience feels familiar. Over time, online lottery participation becomes a gateway rather than a standalone product.

Monetization and Customer Lifetime Value

Long-term profitability depends on retention. Lottery-based platforms excel here because they encourage routine behavior. Weekly or monthly play keeps accounts active, which increases customer lifetime value. Even small transaction fees add up when volume is high and churn stays low.

Many operators reinvest lottery revenue into product development, data analytics, and responsible gambling tools. These investments support sustainable growth and strengthen regulatory relationships. In markets where rules are evolving, lottery services often remain stable anchors for compliance.

The Broader Business Picture

The rise of online lottery sales reflects a broader trend in digital wagering, convenience paired with transparency wins market share. Companies that treat lottery offerings as core products rather than add-ons gain access to mass audiences and reliable cash flow. Over time, this foundation supports expansion into higher-margin betting verticals.

From a strategic view, online lottery engagement shows how trust, automation, and user-friendly design can scale a gambling business responsibly. These lessons apply across the industry, from entry-level games to advanced betting markets.

Looking Ahead

As regulation and technology continue to shape the sector, lottery platforms will remain central to digital wagering strategies. The ability to introduce users through familiar, low-risk products while offering room to explore more complex bets is powerful. Businesses that understand how and why people buy lottery online will be better positioned to grow, adapt, and compete in the expanding global betting market.

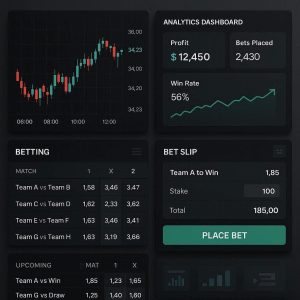

Betting used to be seen as a simple activity based on chance. People placed bets, waited for results, and accepted whatever happened. Today, betting works very differently. It has grown into a structured industry that operates like a modern business. Platforms plan carefully, study data, and build systems to support long-term growth. Luck still plays a role, but structure now matters just as much.

Betting used to be seen as a simple activity based on chance. People placed bets, waited for results, and accepted whatever happened. Today, betting works very differently. It has grown into a structured industry that operates like a modern business. Platforms plan carefully, study data, and build systems to support long-term growth. Luck still plays a role, but structure now matters just as much. The gambling industry has changed fast over the past decade. What was once limited to physical casinos is now available on mobile phones. Cassino Bet apps have become a major part of this shift. These apps are not only about games. They are also strong business platforms. They use technology, marketing, and data to grow revenue and reach new users.

The gambling industry has changed fast over the past decade. What was once limited to physical casinos is now available on mobile phones. Cassino Bet apps have become a major part of this shift. These apps are not only about games. They are also strong business platforms. They use technology, marketing, and data to grow revenue and reach new users. Gambling has changed a lot in the past decade. It is no longer limited to casinos or betting shops. Today, betting apps allow people to place wagers using their phones anytime and anywhere. This shift has created a strong connection between business and gambling. What was once a physical industry has now become a digital business model driven by technology, data, and user behavior.

Gambling has changed a lot in the past decade. It is no longer limited to casinos or betting shops. Today, betting apps allow people to place wagers using their phones anytime and anywhere. This shift has created a strong connection between business and gambling. What was once a physical industry has now become a digital business model driven by technology, data, and user behavior.

Millions chase lucky numbers daily in India’s underground betting scene. Satta King 786 stands out as a popular choice among players. Platforms track results and build communities around these games. They turn simple data into full businesses.

Millions chase lucky numbers daily in India’s underground betting scene. Satta King 786 stands out as a popular choice among players. Platforms track results and build communities around these games. They turn simple data into full businesses. Sports betting has a way of pulling people into emotional traps. You watch your favorite team, the odds look tempting, and you convince yourself you’ve spotted an edge. But more often than not, those “gut” calls aren’t as sharp as they feel in the moment. That’s where

Sports betting has a way of pulling people into emotional traps. You watch your favorite team, the odds look tempting, and you convince yourself you’ve spotted an edge. But more often than not, those “gut” calls aren’t as sharp as they feel in the moment. That’s where  Slot diversification: JILI has added to a larger range of slot games, including those not traditional table games, live casino, and video poker.

Slot diversification: JILI has added to a larger range of slot games, including those not traditional table games, live casino, and video poker. Slot machines are a much-loved pastime for so many, yet it can be easy to overlook the tax consequences of your wins. Whether you’re a casual player or someone with a bankroll large enough to run a gaming operation, understanding the tax laws that apply to your slot machine winnings, even on a trusted slots 2025 (slot terpercaya 2025) is crucial. After all, there’s no reason to be hit with a tax shocker after an already bright and exciting lights kind of day.

Slot machines are a much-loved pastime for so many, yet it can be easy to overlook the tax consequences of your wins. Whether you’re a casual player or someone with a bankroll large enough to run a gaming operation, understanding the tax laws that apply to your slot machine winnings, even on a trusted slots 2025 (slot terpercaya 2025) is crucial. After all, there’s no reason to be hit with a tax shocker after an already bright and exciting lights kind of day. No more manual spreadsheets. Modern casino CMSs simplify inventory management. See machine performance, maintenance, and player preferences at a glance.

No more manual spreadsheets. Modern casino CMSs simplify inventory management. See machine performance, maintenance, and player preferences at a glance. Suppose there were very low betting limits in a casino. The day’s results could be thrown for a loop if a high roller strolls in and bets a huge sum. Risk management is useful in this situation. Businesses can reduce the financial risks linked to excessive wagering and possible fraud by instituting responsible betting limits and conducting behavior analysis on customers.

Suppose there were very low betting limits in a casino. The day’s results could be thrown for a loop if a high roller strolls in and bets a huge sum. Risk management is useful in this situation. Businesses can reduce the financial risks linked to excessive wagering and possible fraud by instituting responsible betting limits and conducting behavior analysis on customers.

More than 70% of casino revenue worldwide comes from slot machines. These colorful, flashing games are not just entertainment; they are carefully engineered profit engines. While table games like poker and blackjack get the spotlight, slots quietly bring in steady earnings that keep casinos thriving.

More than 70% of casino revenue worldwide comes from slot machines. These colorful, flashing games are not just entertainment; they are carefully engineered profit engines. While table games like poker and blackjack get the spotlight, slots quietly bring in steady earnings that keep casinos thriving.

If the match is hosted in Indonesia or Japan, the local economy benefits from a surge in tourism. Hotels, restaurants, and transportation services experience noticeable spikes in demand. Football tourism—especially tied to major qualifiers—drives millions in short-term economic activity.

If the match is hosted in Indonesia or Japan, the local economy benefits from a surge in tourism. Hotels, restaurants, and transportation services experience noticeable spikes in demand. Football tourism—especially tied to major qualifiers—drives millions in short-term economic activity.

The Thai government rigorously controls internet gaming. A company’s legal operation depends on acquiring a license. Navigating this difficult process requires working with seasoned legal counsel.

The Thai government rigorously controls internet gaming. A company’s legal operation depends on acquiring a license. Navigating this difficult process requires working with seasoned legal counsel. Baccarat has long been a favorite game among high-stakes players worldwide, especially in luxury casino resorts. Unlike other card games, Baccarat attracts high rollers due to its straightforward gameplay, competitive odds, and the allure of exclusivity that casinos work hard to maintain. High rollers play a crucial role in boosting casino profits. Top casinos have devised strategies to cater specifically to these players, enhancing both their gaming experience and the casino’s revenue.

Baccarat has long been a favorite game among high-stakes players worldwide, especially in luxury casino resorts. Unlike other card games, Baccarat attracts high rollers due to its straightforward gameplay, competitive odds, and the allure of exclusivity that casinos work hard to maintain. High rollers play a crucial role in boosting casino profits. Top casinos have devised strategies to cater specifically to these players, enhancing both their gaming experience and the casino’s revenue. Online lottery platforms are rapidly changing the gambling industry, providing users with easier access to various games from anywhere in the world. These platforms have become trusted agents, offering secure services and boosting users’ confidence. The global lottery market, worth billions, has seen significant growth due to these online services, leading to new business opportunities for operators and a shift in how gambling is perceived.

Online lottery platforms are rapidly changing the gambling industry, providing users with easier access to various games from anywhere in the world. These platforms have become trusted agents, offering secure services and boosting users’ confidence. The global lottery market, worth billions, has seen significant growth due to these online services, leading to new business opportunities for operators and a shift in how gambling is perceived.